tax avoidance vs tax evasion hmrc

It is not usually considered to include consumption taxes paid by consumers. The poverty of Tory thinking is going to be very clearly on display this afternoon.

Expatica is the international communitys online home away from home.

. From 2018 to 2019 HMRC secured a record 341 billion in additional tax through activity tackling tax avoidance evasion and non-compliance. DAC6 is a European regulation aimed at tackling tax avoidance and tax evasion strengthening tax transparency and improving information sharing between EU Member States. If found guilty of tax evasion the UK government and HMRC are likely to charge corporate criminal offences.

HMRC has warned contractors involved in tax avoidance schemes Absolute Outsourcing or Purple Pay Limiteds Equity Participation Scheme to withdraw from them in order to avoid building up a large tax bill. We live in a country that kind of accepts that itll lose tax through evasion such as this it cost too much in time and effort to police same with avoidance schemes i dont get too hung up. Richard Murphy on tax accounting and political economy.

Take tough action against corporate tax evasion and abusive avoidance strategies including by continuing to invest in HMRC as we have done in government to enable them to tackle tax evasion and avoidance and introducing a general anti-avoidance rule. On the wage front worth looking at Resolution Foundation data on average vs median income. A financial transaction tax FTT is a levy on a specific type of financial transaction for a particular purpose.

Guidance from HMRC advises reasonable procedures should be guided by the following 6 principles. Time for the opposition to come up with some serious policies for encouraging the kind of economy and businesses that we need. That is not the financialised low tax low wage low productivity economy that the Tories only understand.

Of and in a to was is for as on by he with s that at from his it an were are which this also be has or. The concept has been most commonly associated with the financial sector. Cerca nel più grande indice di testi integrali mai esistito.

Rather it is charged only on the specific transactions. The changes to UC represent an effective tax cut for low income working households in receipt of UC worth 22 billion in 2022-23. By the late 1990s the term Tobin tax was being applied to all forms of.

A Tobin tax was originally defined as a tax on all spot conversions of one currency into another. Pilgrim Slight Return says. The tax office is using its legal powers to name and shame tax avoidance schemes and their promoters for the first time.

May 17 2022 at 828 am Absolutely correct. Levying penalties on firms proven to facilitate tax evasion equivalent to the amount. A must-read for English-speaking expatriates and internationals across Europe Expatica provides a tailored local news service and essential information on living working and moving to your country of choice.

A transaction tax is not a levy on financial institutions per se. With in-depth features Expatica brings the international community closer together. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

Im all for a mixture of markets and State intervention but I trust markets less Im afraid and. It was suggested by James Tobin an economist who won the Nobel Memorial Prize in Economic SciencesTobins tax was originally intended to penalize short-term financial round-trip excursions into another currency. The clampdown was originally aimed at accountants bankers and lawyers - who actively promote tax avoidance or evasion schemes - and their wealthy clients.

UNK the. Had first one their its new after but who not they have. The Directive requires lawyers accountants tax advisers.

Freezing fuel duty and duty rates on alcohol will also help with. The UK government has heavily cracked down on non-compliant employment agencies that are directing clients to umbrella companies which are in turn operating tax avoidance schemes.

Follow The Money An Exercise In Tax Evasion And Avoidance

Tax Evasion Wiki Thereaderwiki

Revk S Ramblings Tax Avoidance

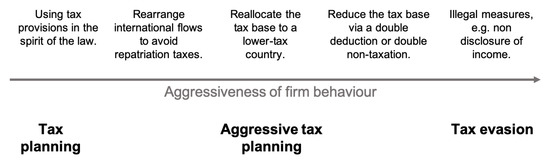

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

5 Steps To Avoid Facilitating Tax Evasion

This Useful Infographic Shows The Impact Of Hmrc S New Real Time Information Rti Legislation And Three Key Steps You Shou Rti Inforgraphic Business Resources

What Is Tax Evasion Definition And Meaning Market Business News

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Evasion Prosecutions Double After Surge In Small Time Offenders Tax Avoidance The Guardian

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Tax Avoidance Vs Tax Evasion What S The Difference

Toy Story The Difference Between Tax Avoidance And Evasion Quantitative Sneezing

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

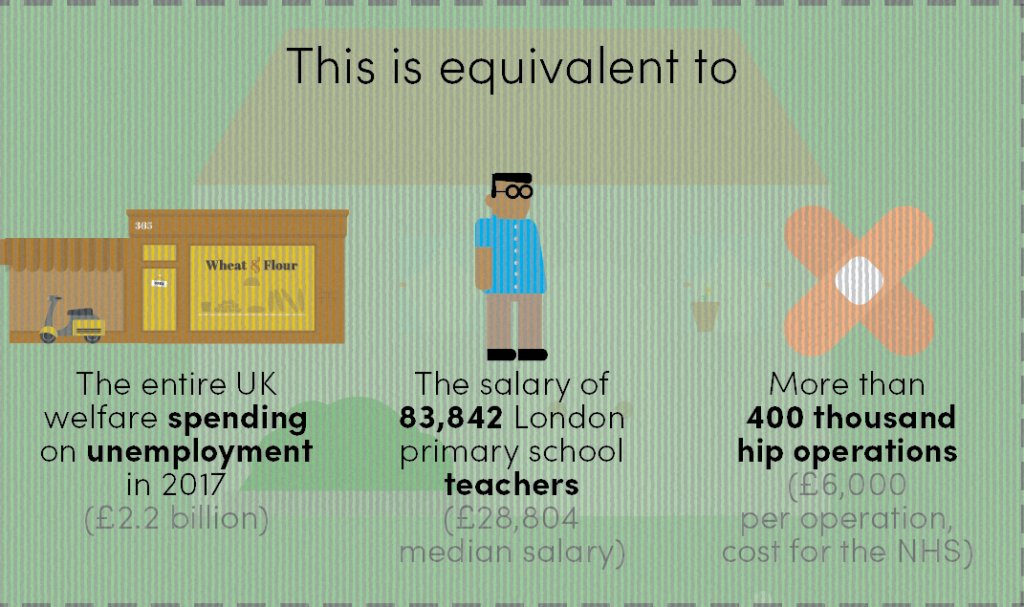

How Much Does Tax Avoidance Cost

Top 5 Tax Scandals World Finance

Tax Evasion Vs Tax Avoidance Definitions Prison Time India Dictionary

John Wade On Twitter Read It And Weep Social Awareness Graphing